We have the perfect loan for your home, investment, or business..

Whether you're buying, refinancing, or investing,

we have the right mortgage solution for you.

Unlock Lower Payments with Our Temporary Buydown Programs!

Are you worried about high interest rates making your dream home unaffordable? Our temporary buydown options can help by lowering your monthly mortgage payments for the first 1-3 years. It's a smart way to ease into homeownership!

How it Works (Simple as 1-2-3)

The seller, builder, or lender pays an upfront amount to reduce your interest rate temporarily.

Choose from plans like:

1-Year Buydown: 1% lower rate for the first year.

2-1 Buydown: 2% lower in year 1, 1% lower in year 2. (Most Popular)

3-2-1 Buydown: 3% lower in year 1, 2% in year 2, 1% in year 3.

After the buydown period, your payments adjust to the original rate.

Why Choose a Buydown?

Save Money Upfront: Lower payments mean more cash for moving, furniture, or savings.

Build Equity Faster: Start with affordable payments while your home value grows.

No Surprises: We'll walk you through the details so you know what to expect.

Ready to see if this fits your budget? Contact us for a free quote!

🏡 Home Purchase Loans

Conventional Loans – Ideal for borrowers with good credit, offering low rates and flexible terms.

FHA Loans – Great for first-time buyers with low down payments (3.5%) and flexible credit requirments.

VA Loans – 0% down payment options for eligible veterans and active-duty service members.

USDA Loans – 100% financing for homes in eligible rural areas.

Jumbo Loans – Financing for homes above conventional loan limits (higher-priced homes).

Non-QM Loans – Perfect for self-employed borrowers, investors, and those with unique income situations.

💰 Refinance & Cash-Out Loans

Rate & Term Refinance – Lower your rate or adjust your loan term to save money.

Cash-Out Refinance – Use your home equity to consolidate debt, fund home improvements, or invest.

FHA Streamline Refinance – Fast and easy refi with no appraisal or income verification required.

VA IRRRL (Interest Rate Reduction Refinance Loan) – Simple refinance for VA loan holders to lower payments.

🏡 Home Equity & Specialty Loans

HELOC (Home Equity Line of Credit) – Flexible access to your home equity with low interest rates.

Fixed-Rate Second Mortgages – Keep your first mortgage rate and tap into equity with a second loan.

📈 Investment Property & Business Loans

DSCR Loans (Investor Loans) – Qualify based on rental income, not personal income.

Fix & Flip Loans – Short-term financing for investors flipping properties.

Hard Money Loans – Fast funding for real estate investors needing flexible credit guidelines.

Commercial Real Estate Loans – Funding for apartment buildings, office spaces, and commercial properties.

SBA Loans – Small Business Administration loans for business expansion or property purchases.

🎓 Specialty & Niche Loans

Bank Statement Loans – Great for self-employed borrowers who don’t use traditional W-2 income.

1099 Loans – Designed for independent contractors and gig workers.

ITIN Loans – Home loans for non-U.S. citizens with an Individual Taxpayer Identification Number.

No-Doc & Low-Doc Loans – Minimal documentation loans for fast approval.

Need help finding the right loan? Contact us today!

If you have any questions we didn't answer, please email

info@FliteFinancial.com

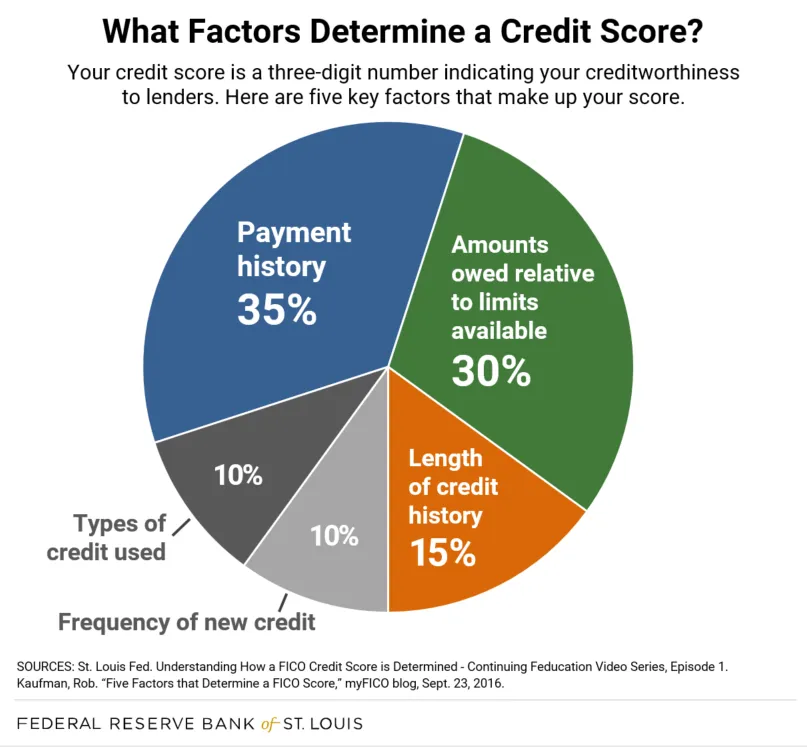

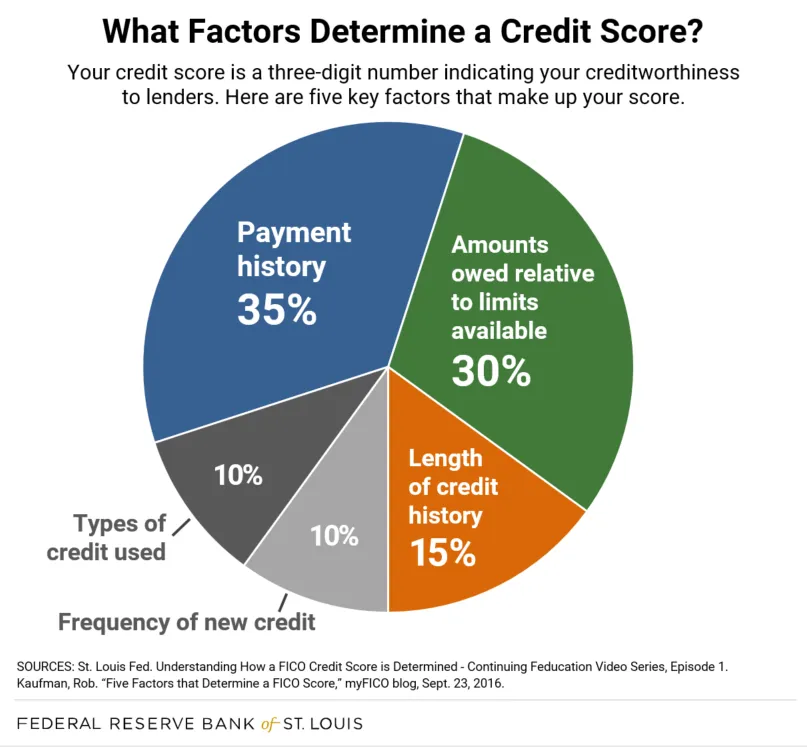

How Credit Scores Work: The 5 Key Factors

Understanding how credit scores work:

#1. Most Important - Payment History (35%) – On-time payments are crucial. Even one missed payment can lower your score, making it harder to qualify for a mortgage.

#2 Credit Utilization (30%) – Keeping credit card balances low (below 10% of your limit) improves your score and signals responsible credit use.

#3 Length of Credit History (15%) – The longer you’ve had credit accounts open, the better. Lenders like to see a well-established track record.

#4 Types of Credit Used (10%) – A combination of revolving credit (credit cards) and installment loans (auto, student, or mortgage loans) helps improve your score.

#5 Frequency of Credit (10%) – Too many recent applications can temporarily lower your score, so be strategic when applying for new credit.

If you have any questions we didn't answer, please email

info@FliteFinancial.com

This material is presented for informational purposes only and should not be construed as individual tax or financial advice. Flite Financial, nor any of it's affiliates, do not provide legal advice. By selecting any external link on FliteFinancial.com, you will leave the Flite Financial website and jump to an unaffiliated third-party website that may offer a different privacy policy and level of security. The third party is responsible for website content and system availability. Flite Financial does not offer, endorse, recommend or guarantee any product or service available on that entity's website.

I just want to take a moment to express my heartfelt gratitude to every single member of my amazing team at Flite Financial. Your dedication, hard work, and unwavering support are the foundation of our success, and I truly couldn’t do it without you. Each of you brings something unique and invaluable to the table, and together, we’ve built something truly special. Whether it’s going above and beyond for our clients, solving challenges with creativity, or supporting each other through every step of the process, I’m incredibly grateful for everything you do. Thank you for being such a vital part of this journey – I’m lucky to have such an extraordinary team by my side!

~ Brad Barton

© 2024 Flite Financial, Inc. - All Rights Reserved

NMLS ID 2554429

2825 E Cottonwood Parkway, Suite 500

Salt Lake City, UT 84121

Fax 801-405-7693

VA Lender ID 9782250000